Back in 2013, Dave Ripley became fascinated with Bitcoin. The cryptocurrency market was gaining notoriety and Ripley and a friend decided to start Glidera, a company focused on creating tools to help developers integrate cryptocurrency.

Ripley and his partner applied for and won a spot in Techstars, an accelerator that takes between 6% and 8% equity in the businesses they accept in return for access to an intensive start-up curriculum and a network of advisors.

They sold another chunk of the company to a group of Techstars advisors and finally sold the whole business to Kraken, one of the world's largest bitcoin exchanges.

In this episode, you’ll learn:

- The difference between pitching your company to an investor vs. an acquirer

- Why Bitcoin is growing as an alternative to the world’s fiat currencies

- How accelerators like Techstars work

- How not to get taken advantage of in the incestuous world of angels

The Latest Built to Sell Forbes Column

The Build vs. Buy Equation - If you’re wondering what your business might be worth to an acquirer, there is a simple calculation you can use. Let’s call it “The Build vs. Buy Equation”.

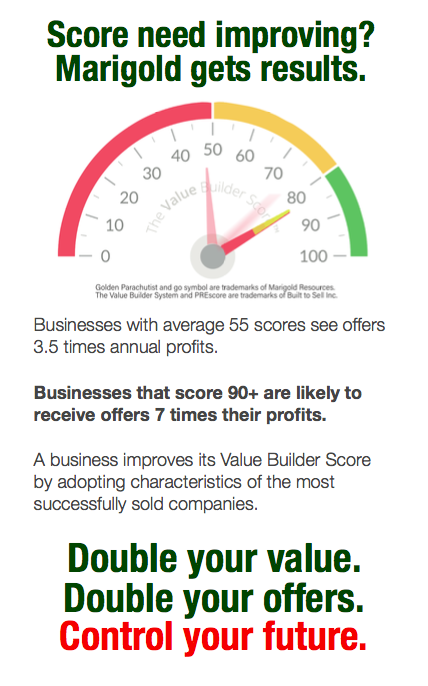

Find out how you score on the eight factors that drive your company’s value by completing the Value Builder questionnaire: