What % of Your Net Worth Is Your Business' Market Value?

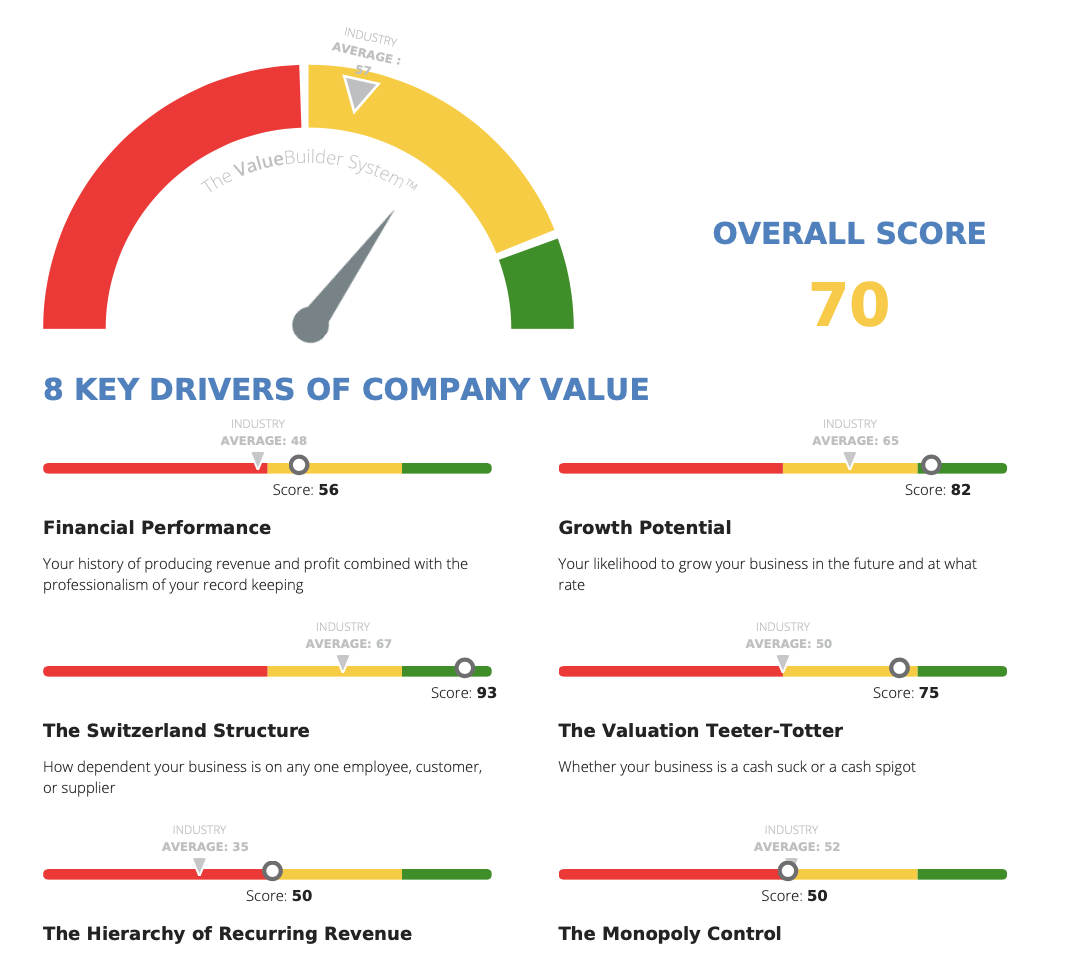

Value Builder™ Score

How “buyer-ready” is your business across 8 Key Value Drivers, what are the gaps, and what is its current estimated value?

Personal Readiness to Exit

How ready are you to let go? Where do you land on the 4 key drivers for a satisfying and lucrative business exit?

Freedom Point Score

When Was the Last Time You Calculated the % of Your Net Worth Tied to Your Business' Market Value?

From Sellers & Buyers

Customer Testimonials

A Trusted Name

“There is a reason Marigold Resources is a trusted name in the Quad Cities & beyond! My husband and I purchased a business in the summer of 2023. Chris & Todd held our hand through every step of the process, and if any issues arose, they quickly were able to brain storm ideas & get us in touch with the right people. We couldn’t have been happier with our purchase through Marigold Resources & I’d recommend Chris & Todd to anyone looking to buy or sell a business.” - Sara & Matt DeWulf / Owners, Eldridge Lumberyard

Process That Gets Results

“Many times I have a hard time truly relaying what I wanted to say, and especially with Chris he could almost say it word for word. He saw my bubble. It's a complete team with a well defined process that does get results. Marigold's tools, expertise and contacts streamlined our exit strategy just right.” - Ken & Beth Roberts / Founders, Roberts Custom Software

Advised Us For Five Years

“Marigold advised TMS for five years and helped us grow its value, so we could achieve our end-game. They brought us numerous offers from publicly traded companies to private investment groups. You have to have a negotiator like Marigold because it's your baby you're selling. You're still trying to run your company, you think the deal's going to go through, and it takes only one thing for the deal to be off. They are worth every percent they are getting to sell your company and you have to figure that into your exit strategy.” - Rod Schmidt / Co-Founder, Total Maintenance Solutions

Business Brokers, M&A Advisors Since 2011

Sold Transactions

Average Days in Market

Average Asking Price Multiple of Profits

average value builder score for listed sellers

Your Advisors

Chris Barnard

Managing Partner

Todd McGreevy

Managing Partner