Annual Sales

- 2016: $1.7MM

- 2017: $1.9MM

- 2018: $1.9MM

- 2019: $1.8MM

- 2020: $1.8MM

- 2021 $2.0MM

- 2022: $2.25MM

- 2023: $2.01MM

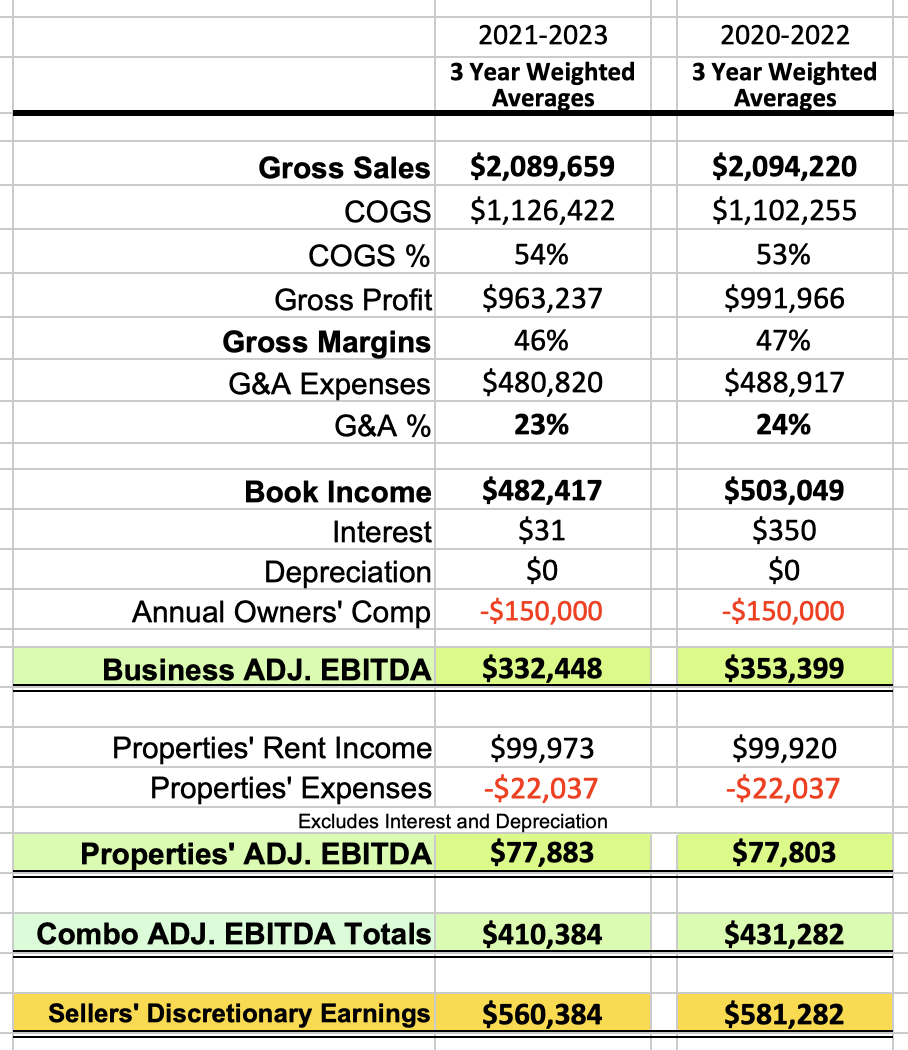

- 3 Year Weighted Annual Average Adjusted EBITDA: $332K

- 3 Year Weighted Annual Average Adjusted EBITDA w CRE: $410K

- 3 Year Weighted Annual Seller’s Discretionary Earnings (SDE): $560K The Business makes and repairs parts & equipment for the leading 24/7 industrial businesses and corporations predominantly operating on or near the Mississippi River.

The Business provides Machining, Fabrication and Millwright services to industrial, manufacturing and mining customers who rely on the Business for both large scale heavy-duty problem solving, fabrication and assembly, as well as smaller scale higher volume recurring job shop metal finishing.

The two founders started this business in 2003 after working with various regional industrial customers and service providers for over 46 years combined.

Seventeen years later, with over 80 years combined problem solving behind them, both are focused on the most effective transition of their knowledge to a new generation.

The Sellers have engaged Marigold to find the strategic Buyer who can most effectively leverage their experience, equipment, customers and capacity.

- Business Asking Price: $1,200,000

- Seller willing to finance up to 20% of sales price, terms to be determined.

- Non-Disclosure Agreement Link

Background

The business employs 10 full-time employees, half of which manage fabrication projects and the other half of which manage machining projects. Select team members will go on-site to customer’s job sites to do consulting, custom fabrication, installations and repairs.

Both Sellers (50/50 ownership) are currently working full-time as well.

One Seller (currently focused on fabrication projects and finance) is open to working for a new owner in business development and sales, having an extensive sales background.

And, this Seller is also open to going fishing more often, too.

The other Seller (currently focused on machining projects & on-site customer problem solving) would prefer to continue working for the new owner for 1-3 years in order to ensure his legacy information and contacts are successfully transitioned to the new owner.

3 Year Weighted Averages Year End 2023 v 2022

Equipment FMV Over $640,000

Sellers have extensive equipment suitable for large scale heavy duty fabrication and repairs as well as small scale small volume highly technical finish work.

Midwest Location Valued at $800,000

Seller’s Valuation of its property is $800,000 and is not included in Business Purchase Price above. Seller prefers to sell the property with the business.