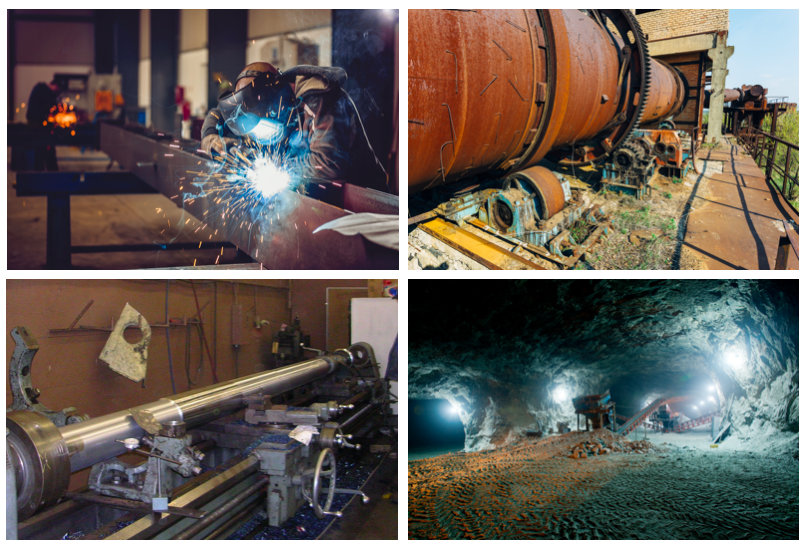

East Iowa Full Service Auto, RV & Fleet Repair Business

A full-service automotive repair shop with two locations offering a comprehensive list of auto repair services ranging from tire repair to engine repair. The business also manages repairs and maintenance for commercial fleets and recreational vehicles.

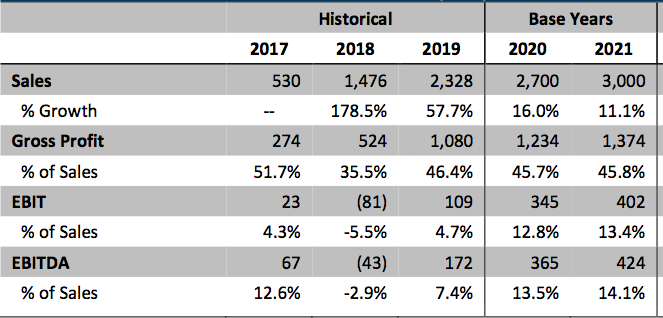

A full-service automotive repair shop with two locations offering a comprehensive list of auto repair services ranging from tire repair to engine repair. The business also manages repairs and maintenance for commercial fleets and recreational vehicles.2023 Gross Sales: $3,024,000

2023 SDE $379,000

2023 EBITDA $274,000

2022 Gross Sales: $3,525,000

2022 SDE: $689,000

2022 EBITDA: $573,000

Business Asking Price: $2,500,000